How to Invest in Airfreight Transportation in 2025-2030

The global airfreight transportation sector is set to soar in the coming years, driven by the rapid growth of e-commerce, global trade recovery, and the need for faster logistics solutions. Between 2025 and 2030, industry advancements in green aviation and technological innovations will further reshape this dynamic market, presenting unique opportunities for investors.

In this article, we’ll explore how to invest in airfreight transportation, assess market trends, and offer strategies to maximize returns. Additionally, we’ll show how Certuity’s family office services can help you navigate the complexities of airfreight investment.

Why Invest in Airfreight Transportation?

Airfreight transportation plays a critical role in the global supply chain, offering unmatched speed and reliability for delivering goods. Several factors make this sector an attractive investment:

- E-Commerce Growth: With e-commerce sales projected to surpass $7 trillion by 2030, the demand for airfreight services will rise exponentially.

- Global Trade Expansion: The World Trade Organization (WTO) anticipates annual global trade growth of 2.5%-3.0%, benefiting the air cargo industry.

- Time-Sensitive Shipments: Pharmaceuticals, perishables, and electronics rely on airfreight for timely delivery, further boosting demand.

As billionaire investor Warren Buffett said, “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

How to Invest in Airfreight Transportation

1. Invest in Airfreight Carriers

Major airlines with dedicated cargo divisions dominate the airfreight industry. Investing in their stocks can offer exposure to this growing sector.

2. Freight Forwarding Companies

Freight forwarders like Expeditors International and Kuehne + Nagel act as intermediaries between shippers and carriers, managing logistics and cargo transportation. These companies are well-positioned to benefit from growing trade volumes.

3. Air Cargo Infrastructure

Investing in infrastructure such as airports, cargo hubs, and warehouses can yield consistent returns. For example:

- Specialized cold storage facilities for pharmaceuticals.

- Automation technologies to streamline cargo handling.

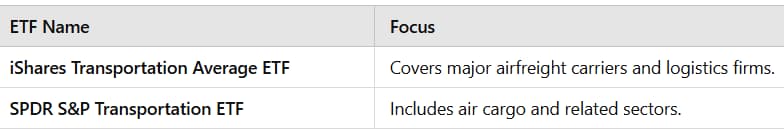

4. Airfreight ETFs

Exchange-Traded Funds (ETFs) focused on transportation or logistics provide diversified exposure to the airfreight industry.

5. Green Aviation Innovations

The push toward sustainability is transforming the airfreight industry. Investing in companies developing green aviation technology—such as electric aircraft or sustainable aviation fuels—offers long-term growth potential.

Market Trends for 2025-2030

- E-Commerce Dominance: Same-day and next-day delivery demands are driving airfreight growth.

- Automation and AI: Automation in cargo handling and AI-powered route optimization will reduce costs and increase efficiency.

- Sustainability Goals: Airlines are adopting sustainable aviation fuels (SAF) and reducing emissions to comply with global climate goals.

- Regional Growth: Asia-Pacific and Middle Eastern markets are expected to lead in air cargo volume due to trade expansion.

- Digital Freight Platforms: Startups offering digital cargo booking and tracking systems are gaining traction, streamlining operations for both carriers and shippers.

Risks and Mitigation Strategies

Investing in airfreight transportation comes with its own set of challenges:

A Vision for the Future

Airfreight investments not only promise financial returns but also drive global connectivity. As Amazon founder Jeff Bezos famously said, “Your margin is my opportunity.” The airfreight industry is well-positioned to capitalize on innovations, creating ample opportunities for savvy investors.

Certuity: Your Trusted Partner in Investment

Navigating the complexities of airfreight investment requires expertise. Certuity offers comprehensive family office services, guiding you through investment opportunities, risk management, and financial strategies.

Certuity Contact Information:

- Website: https://certuity.com/family-office/

- Address: Manhattan Beach, CA, and Miami, FL.

- Phone: (305) 123-4567

With Certuity’s support, you can build a diversified portfolio that aligns with your long-term financial goals.

Conclusion

The airfreight transportation industry is entering a new era of growth and innovation, offering investors a wealth of opportunities. Whether through direct investment in carriers, freight-forwarding companies, or green aviation technologies, there are multiple ways to capitalize on this booming sector.

By partnering with trusted advisors like Certuity, you can navigate this dynamic market with confidence and achieve sustainable financial success. Start your investment journey today and take flight toward a prosperous future!